Understanding the Surge in Credit Card Defaults

January 10, 2025 - 00:56

Credit card defaults among Americans have hit a concerning peak, reaching the highest level seen in 14 years. This alarming trend can be attributed to a combination of soaring credit card debt and persistent high inflation rates. As consumers grapple with rising costs, many are struggling to keep up with their monthly payments.

A borrower is considered to be in default when they fail to make credit card payments for more than 180 days, or roughly six months. This situation not only affects the individual’s credit score but can also lead to significant financial repercussions. As defaults increase, it raises concerns about the overall economic landscape and the potential for a ripple effect that could impact lenders and the economy at large.

Financial experts urge consumers to be proactive in managing their debt and to seek assistance if they find themselves unable to meet their payment obligations. Understanding the implications of defaulting on credit cards is crucial for maintaining financial health in these challenging times.

MORE NEWS

January 29, 2026 - 05:24

Yield curve vs. Japanese bonds: Which is a bigger market risk?A leading fixed income strategist has highlighted two pressing concerns for the global financial landscape: the dramatic steepening of the U.S. Treasury yield curve and growing instability in the...

January 28, 2026 - 03:36

EU-India trade deal: What investors need to knowEuropean Commission President Ursula von der Leyen has hailed a newly reached trade pact between the European Union and India as the `mother of all deals.` This significant agreement marks a major...

January 27, 2026 - 01:17

Mine Raises $14 Million and Launches AI Personal Finance AgentA new player in the personal finance space has secured significant investment to launch an artificial intelligence-driven financial guide. The company, which focuses on serving young adults,...

January 26, 2026 - 02:26

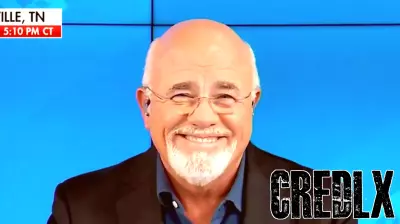

‘They are awful’: Dave Ramsey rips millennials and Gen Z for wanting homes without workingPersonal finance personality Dave Ramsey has sparked controversy with sharp criticism aimed at millennials and Gen Z regarding homeownership. He specifically targeted those living with parents...