Stock Market Update: Dow Declines While S&P 500 and Nasdaq Make Gains Amid Fed Rate Speculations

December 23, 2024 - 21:20

In today's trading session, the stock market experienced a mixed performance as investors grappled with the implications of the Federal Reserve's recent statements regarding interest rates. The Dow Jones Industrial Average faced a decline, reflecting concerns over the central bank's commitment to maintaining higher rates for an extended period. Meanwhile, both the S&P 500 and Nasdaq managed to edge higher, buoyed by optimism in the technology sector and other growth-oriented stocks.

Market analysts noted that the Fed's indication of a prolonged period of elevated interest rates has led to increased scrutiny of economic indicators, as investors weigh the potential impact on corporate earnings and consumer spending. The mixed results in the indices suggest a cautious approach among traders, who are closely monitoring economic data releases and future Fed communications.

As the year progresses, the focus will remain on how these interest rate decisions influence market dynamics and investor sentiment, particularly in light of ongoing inflationary pressures and global economic uncertainties.

MORE NEWS

January 29, 2026 - 05:24

Yield curve vs. Japanese bonds: Which is a bigger market risk?A leading fixed income strategist has highlighted two pressing concerns for the global financial landscape: the dramatic steepening of the U.S. Treasury yield curve and growing instability in the...

January 28, 2026 - 03:36

EU-India trade deal: What investors need to knowEuropean Commission President Ursula von der Leyen has hailed a newly reached trade pact between the European Union and India as the `mother of all deals.` This significant agreement marks a major...

January 27, 2026 - 01:17

Mine Raises $14 Million and Launches AI Personal Finance AgentA new player in the personal finance space has secured significant investment to launch an artificial intelligence-driven financial guide. The company, which focuses on serving young adults,...

January 26, 2026 - 02:26

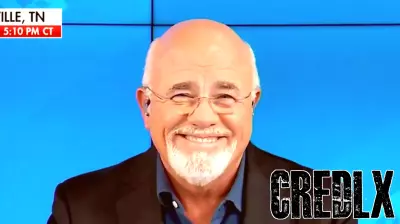

‘They are awful’: Dave Ramsey rips millennials and Gen Z for wanting homes without workingPersonal finance personality Dave Ramsey has sparked controversy with sharp criticism aimed at millennials and Gen Z regarding homeownership. He specifically targeted those living with parents...