Capital One Sees Profit Growth Amid Economic Challenges

April 23, 2025 - 11:24

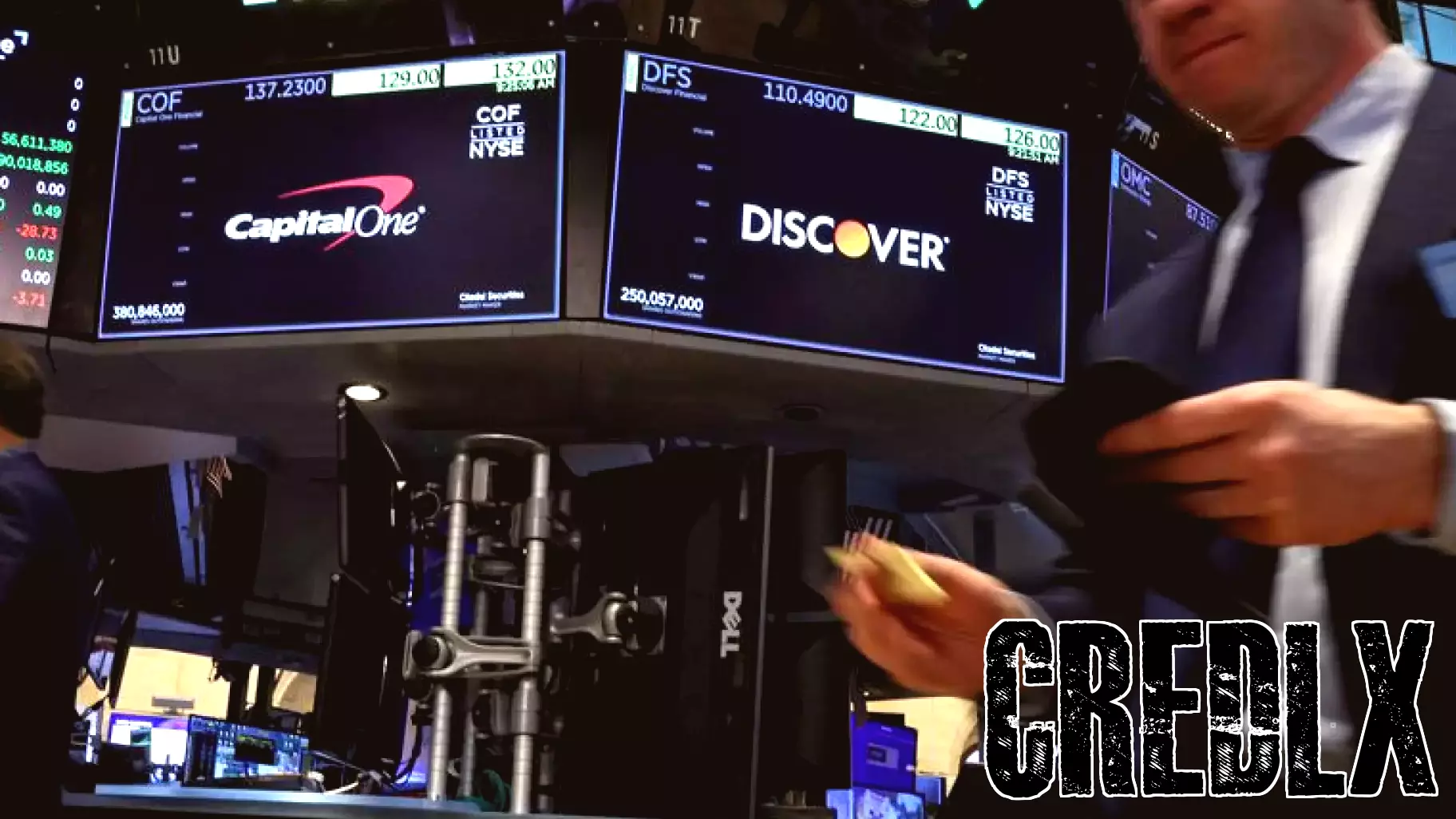

Despite a backdrop of economic uncertainty that has led consumers to cut back on discretionary spending, Capital One has reported a notable increase in profits for the first quarter. This growth can be largely attributed to the surge in interest income from its credit card business, which remains a stronghold for the company.

Interest rates on credit card debt are considerably higher than those associated with mortgages and other loan types, providing a significant revenue stream for Capital One. With nearly half of its loan portfolio comprised of credit card loans, the company is well-positioned to navigate the current market landscape, even as other sectors face challenges.

As consumers become more cautious with their spending, Capital One's reliance on its credit card offerings may continue to bolster its financial performance, allowing it to weather the economic storm while others struggle. The resilience of its credit card business underscores the shifting dynamics within the financial services industry.

MORE NEWS

February 20, 2026 - 18:06

'Your Rich BFF' Vivian Tu shares her favorite personal finance tipsNEW YORK (AP) — Are you intimidated by personal finance? Vivian Tu wants to help. The former Wall Street trader, widely known as `Your Rich BFF,` breaks down complex financial concepts into...

February 20, 2026 - 07:40

LPL Financial announces layoffs at San Diego officeLPL Financial, a major independent broker-dealer, has confirmed a reduction in its workforce at its San Diego headquarters. The company filed a notice with California’s Employment Development...

February 19, 2026 - 21:30

Amazon: Financial Risks Dominate (Rating Downgrade)Amazon`s stock has underperformed both the broader technology sector and the surging artificial intelligence market year-to-date, prompting increased analyst scrutiny. The focus has shifted...

February 19, 2026 - 11:47

ASX Penny Stocks To Watch: Centrepoint Alliance And 2 More Hidden OpportunitiesAs major indices respond to global optimism, a closer look at the Australian Securities Exchange reveals potential beyond the blue chips. While the term `penny stocks` may evoke caution, a...