A Numerical Retrospective on Canadian Finance in 2024

December 29, 2024 - 15:52

TORONTO — As 2024 unfolded, key questions loomed over Canadian finance, primarily centered around the potential for an economic recession and the trajectory of interest rates. Throughout the year, the Canadian economy demonstrated resilience, largely driven by robust consumer spending and a steady job market. Despite global uncertainties, including fluctuating commodity prices and geopolitical tensions, Canada managed to maintain a moderate growth rate.

Interest rates became a focal point for both policymakers and consumers, as the Bank of Canada navigated the challenges of inflation while striving to support economic stability. The central bank's decisions were closely monitored, with many analysts predicting a cautious approach to rate adjustments. This balancing act aimed to foster growth without exacerbating inflationary pressures.

Investors remained vigilant, adjusting their strategies in response to changing market conditions. Overall, 2024 proved to be a pivotal year for Canadian finance, characterized by a blend of challenges and opportunities that shaped the financial landscape for years to come.

MORE NEWS

January 29, 2026 - 05:24

Yield curve vs. Japanese bonds: Which is a bigger market risk?A leading fixed income strategist has highlighted two pressing concerns for the global financial landscape: the dramatic steepening of the U.S. Treasury yield curve and growing instability in the...

January 28, 2026 - 03:36

EU-India trade deal: What investors need to knowEuropean Commission President Ursula von der Leyen has hailed a newly reached trade pact between the European Union and India as the `mother of all deals.` This significant agreement marks a major...

January 27, 2026 - 01:17

Mine Raises $14 Million and Launches AI Personal Finance AgentA new player in the personal finance space has secured significant investment to launch an artificial intelligence-driven financial guide. The company, which focuses on serving young adults,...

January 26, 2026 - 02:26

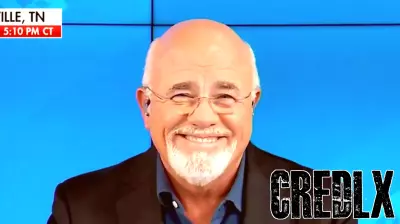

‘They are awful’: Dave Ramsey rips millennials and Gen Z for wanting homes without workingPersonal finance personality Dave Ramsey has sparked controversy with sharp criticism aimed at millennials and Gen Z regarding homeownership. He specifically targeted those living with parents...