Understanding Your Rights as a Student Loan Borrower

17 July 2025

Student loans. Just reading those two words might make your stomach drop a little, right? If you've taken out loans to get through college, you're definitely not alone. But here's the thing: when you're buried in interest rates, monthly payments, and acronyms like FAFSA and PSLF, it's easy to forget that you actually have rights as a student loan borrower. Yes, real rights—like the kind that protect you, give you options, and help you stay afloat financially.

In this article, we’re going to break all that down. Think of this as your go-to guide for understanding what you’re entitled to when it comes to student loans. We’ll go over the basics, your legal protections, options if you’re struggling to pay, and what to look out for so you can take control instead of feeling like you're stuck on a never-ending financial treadmill.

Why It’s Crucial to Understand Your Rights

Let’s face it: student loan debt is overwhelming for millions of people. But a big part of that stress comes from not knowing what you're allowed to do or ask for. The student loan system can feel like a confusing maze—and most of us were never taught how to navigate it.Think of knowing your rights like having a map through that maze. It won’t erase your debt, but it can give you a clearer path forward, maybe even help you avoid a few emotional potholes along the way.

The Basics: Federal vs. Private Loans

First things first—you need to know what type of loan you have. Why? Because your rights and options vary big time depending on whether your loan is federal or private.Federal Student Loans

Most borrowers have federal loans (those backed by the U.S. government). These come with protections and repayment options that private loans usually don’t offer. Plus, your rights are safeguarded by federal law.Some common federal loans include:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Direct Consolidation Loans

If you applied through FAFSA, chances are you’ve got a federal loan.

Private Student Loans

These are issued by banks, credit unions, or online lenders. They often come with fewer protections and less flexibility. It’s kind of like the Wild West—every lender can set its own rules.If you’re unsure what kind you have, log into your account at Studentaid.gov or check your credit report.

Right #1: The Right to Clear Information

You have the right to know what you’re getting into before you sign your life away.That means:

- Full details on interest rates, fees, and repayment options before borrowing

- Access to your full loan history

- Updates on your remaining balance, payment due dates, and interest accrued

Loan servicers are legally required to give you this information—don’t be afraid to ask questions or request documentation.

Right #2: The Right to Repayment Flexibility

One size does not fit all, and thankfully, federal student loans get that. You have a right to pick a repayment plan that fits your income and lifestyle.Standard Repayment Plan

You’ll pay a fixed amount each month for 10 years. Simple, but not always affordable.Income-Driven Repayment (IDR) Plans

These adjust your monthly payments based on how much you earn. Plans include:- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

Monthly payments can be as low as $0 if your income is low enough. After 20–25 years, any remaining debt is forgiven.

Extended and Graduated Repayment

Need a lower payment, but don’t qualify for an IDR plan? These let you spread out payments over 25 years or gradually increase the amount you pay.The bottom line? You have options—and you should never feel trapped in a plan you can’t afford.

Right #3: The Right to Deferment or Forbearance

Life happens. Whether it’s losing a job, going back to school, or dealing with a health crisis, sometimes you just can’t make payments right now.Federal loan borrowers have the right to temporarily pause payments through:

- Deferment: You might not have to pay interest on subsidized loans.

- Forbearance: Interest will usually keep building, but it's still better than missing payments.

Use these strategically. They’re a safety net—not a fix-all.

Right #4: The Right to Loan Forgiveness (In Some Cases)

Believe it or not, your student loan balance doesn’t always have to be a forever thing.Public Service Loan Forgiveness (PSLF)

If you work in government or for a qualifying nonprofit, you might be eligible for forgiveness after 120 payments (that’s 10 years).But—and this is a BIG but—you have to:

- Be on an income-driven plan

- Make payments on a Direct Loan

- Work full-time in qualifying employment

PSLF has had a rocky history with tons of red tape, so track everything and communicate with your loan servicer often.

Teacher Loan Forgiveness

Teachers in low-income schools may qualify for up to $17,500 in forgiveness after five years of service.IDR Forgiveness

Even if you don’t qualify for PSLF, income-driven plans forgive your leftover balance after 20-25 years of on-time payments.Right #5: The Right to Dispute Errors

Loan servicers make mistakes—it's a sad truth. Payments might not be credited correctly, or you could be placed on the wrong repayment plan.You absolutely have the right to:

- Dispute errors on your loan account

- File complaints with the Consumer Financial Protection Bureau (CFPB)

- Demand transparency and accountability from your servicer

Don't ignore red flags. Keep written records of every communication. Being your own advocate is key.

Right #6: The Right to Be Protected from Predatory Practices

Some shady private loan companies and debt relief scams prey on borrowers who are desperate or uninformed.Red flags to watch out for:

- Promises of instant forgiveness

- High upfront fees

- Requests for your FSA ID or Social Security number

If someone says they can “erase your student loans” for a fee—run. You don’t need middlemen to access repayment plans or forgiveness programs. Everything legit can be done for free at Studentaid.gov.

What To Do If You're Struggling To Keep Up

First off—breathe. You’re not a failure because you're struggling to pay student loans. Life throws curveballs, and this system is far from perfect.Here’s what you can do:

- Switch your repayment plan to an income-driven one

- Apply for a temporary hardship deferment or forbearance

- Talk to your loan servicer—they’re not mind readers

- Don’t miss payments; that can wreck your credit score and lead to default

If you’re in default already (usually after 270 days of missed payments), you still have rights. You can get out of default through loan rehabilitation or consolidation. It might feel like digging yourself out of a hole, but it’s totally doable.

How to Stay On Top of Your Loans

Your best defense is staying informed. Here’s a quick checklist for keeping your student loan game strong:✅ Log into your account at studentaid.gov at least once a month

✅ Know your loan servicer and how to contact them

✅ Create a simple payment budget

✅ Set calendar reminders for due dates

✅ Don’t ignore letters or emails from your loan servicer

✅ Bookmark the CFPB and Federal Student Aid websites

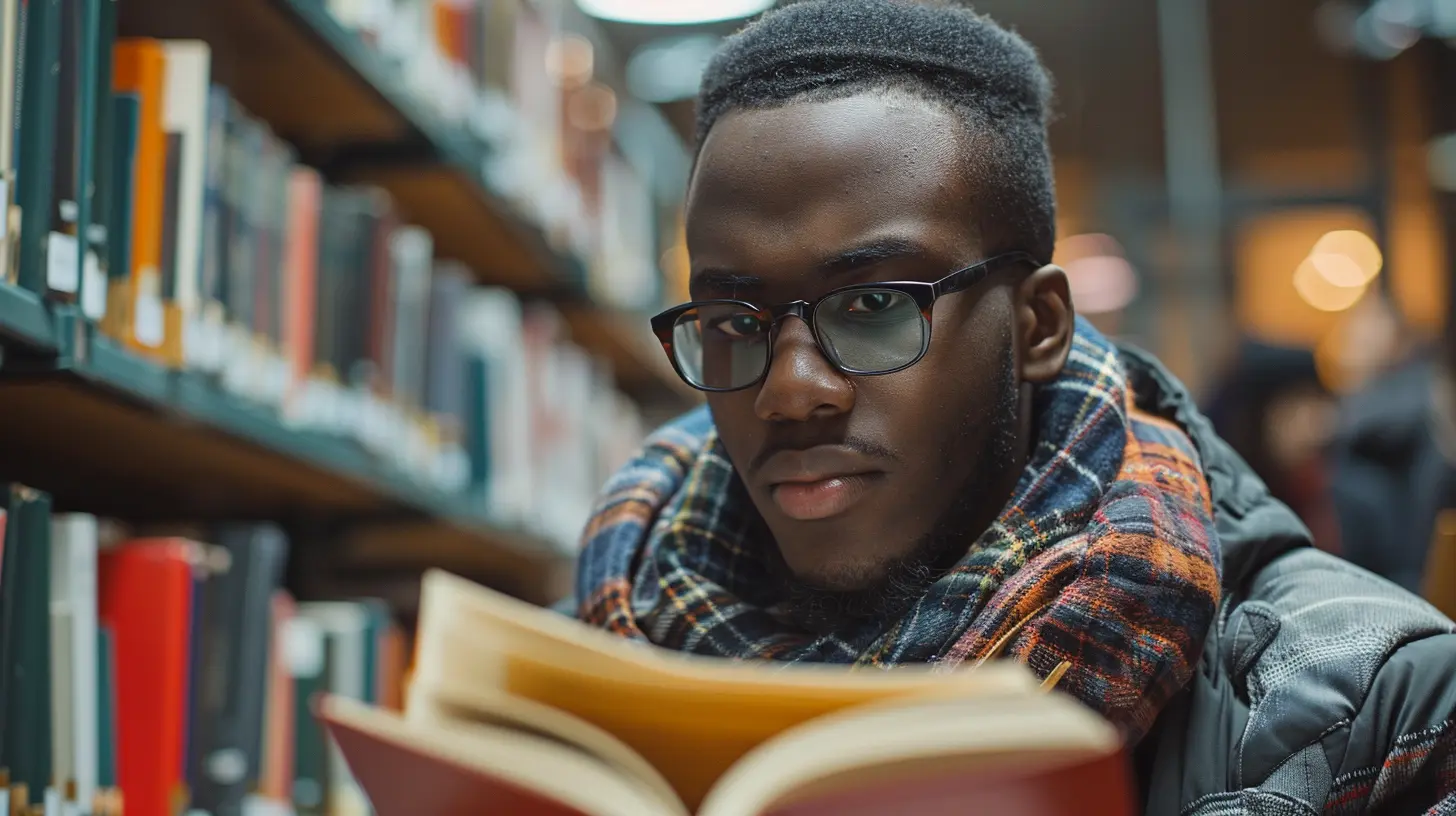

Final Thoughts: You’re Not Alone

If you’ve ever cried over a student loan payment, doubted your decision to go to college, or felt like you’ll never catch up—you’re not the only one.Millions of people are walking this same road with you. The path might be tough, but it’s not hopeless. Understanding your rights is the first step toward taking back control. And hey, you might even sleep a little better tonight knowing you have more options than you thought.

So take a breath, grab your login info, and start checking in on your loans. You've got this.

all images in this post were generated using AI tools

Category:

Student LoansAuthor:

Knight Barrett

Discussion

rate this article

2 comments

Ulrich Lee

Empower your future, know your rights—navigate wisely.

November 22, 2025 at 3:32 AM

Knight Barrett

Thank you! Empowering students with knowledge about their rights is crucial for making informed decisions about their loans.

Finnegan McLean

What an enlightening read! Understanding your rights as a student loan borrower is crucial for making informed financial decisions. This article is packed with helpful insights that empower students to take charge of their loans and navigate their repayment options confidently. Cheers to a brighter financial future! 🌟📚💰

July 28, 2025 at 12:57 PM

Knight Barrett

Thank you for your thoughtful feedback! I'm glad you found the article helpful in understanding your rights and making informed choices. Cheers to your financial journey! 🌟