How Business Confidence Indices Predict Economic Cycles

23 March 2025

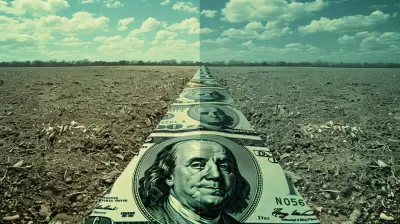

When it comes to understanding the economy, analysts use various tools to gauge where things are headed. One of the most powerful yet often overlooked indicators is the business confidence index. It’s like a weather forecast for the economy—giving us insights into whether we should expect sunshine or prepare for a financial storm.

But how exactly do these confidence indices predict economic cycles? And why should business owners, investors, and policymakers pay attention to them? Let’s break it down in simple terms.

What Is a Business Confidence Index?

A business confidence index (BCI) is a survey-based measurement that reflects how optimistic or pessimistic business leaders feel about the economy. When companies feel good about the future, they invest, hire more people, and expand their operations. On the flip side, when confidence dips, businesses tighten their belts, slow down hiring, and reduce spending—all of which can signal an economic downturn.How Is It Measured?

Governments or independent research organizations usually conduct surveys among business executives, asking them about their outlook on:- Sales expectations

- Employment plans

- Investment intentions

- Overall economic sentiment

The results are then compiled into an index. A number above 100 typically means optimism, while anything below 100 signals pessimism.

The Connection Between Business Confidence and Economic Cycles

Economic cycles follow a predictable pattern: expansion, peak, contraction, and trough. Business confidence indices often move ahead of these phases, making them leading indicators—they change before the economy does.1. Expansion Phase: Confidence Soars

During economic expansion, businesses are booming. Consumer demand is strong, profits are up, and companies feel confident enough to invest heavily. This high optimism is reflected in rising business confidence indices.Example: In the early 2000s, before the global financial crisis, confidence indices were at record highs, signaling a strong economy.

2. Peak Phase: Confidence Begins to Waver

At the peak of the cycle, things seem perfect—but cracks may start to appear. Costs rise, inflation creeps in, and businesses become cautious. The confidence index may stop growing or even slightly decline, indicating that businesses sense a slowdown ahead.3. Contraction Phase: Confidence Drops

When businesses start feeling uncertain, they take fewer risks. They may delay hiring, reduce investment, or even lay off employees. This decline in business confidence can predict recessions before they officially hit.For example, before the 2008 financial crisis, business confidence indices started falling months before the stock market crash, signaling trouble ahead.

4. Trough Phase: Confidence Slowly Recovers

After a recession, confidence doesn’t bounce back overnight. Businesses remain cautious before they start investing again. But once they do, the confidence index rises, hinting at an upcoming recovery.

Why Business Confidence Indices Matter

1. Early Warning System for Economic Changes

Think of business confidence indices like the canary in the coal mine. When confidence drops sharply, it’s often a sign that a downturn is coming. Policymakers, investors, and businesses can use this data to prepare for tough times ahead.2. Helpful for Investment Decisions

Investors use confidence indices to predict market movements. If confidence is strong, it might be a good time to invest in stocks and business expansion. If it’s falling, it might signal the need for a more cautious approach.3. Guidance for Government Policies

Governments use business confidence data to adjust their policies. For example, if confidence is low, central banks may lower interest rates to encourage borrowing and investment.4. Impact on Employment Trends

High business confidence often leads to job growth because companies are more willing to hire. Conversely, when confidence weakens, job cuts and hiring freezes may follow.

Limitations of Business Confidence Indices

While these indices are powerful tools, they aren’t perfect. Here are a few limitations:- Subjective Nature: They rely on opinions rather than hard data. Business leaders may be overly optimistic or pessimistic.

- Short-Term Reactions: Confidence can fluctuate due to temporary factors like political events or global uncertainty.

- Not Always Accurate Predictors: While they provide insights, they should be used alongside other economic indicators like GDP growth, unemployment rates, and inflation data.

How You Can Use Business Confidence Data

If you’re a business owner, investor, or just someone interested in economic trends, paying attention to business confidence indices can help you make smarter decisions. Here’s how:- Business Owners: Use confidence levels to gauge the right time to expand or cut costs.

- Investors: Align your stock market or real estate investments with economic expectations.

- Job Seekers: If confidence is rising, companies may be hiring more. If it’s falling, a downturn could be ahead.

- Policymakers: Adjust government spending and monetary policies based on business sentiment.

Conclusion

Business confidence indices act like a crystal ball for the economy, providing early signals of upcoming booms and busts. While they aren’t foolproof, they serve as a valuable tool for anyone looking to understand economic cycles and make informed decisions.So next time you hear about a confidence index rising or falling, pay attention—it might just be hinting at what’s coming next in the economic landscape.

all images in this post were generated using AI tools

Category:

Economic IndicatorsAuthor:

Knight Barrett

Discussion

rate this article

8 comments

Lacey McGillivray

Thank you for this insightful article! The connection between business confidence indices and economic cycles is fascinating. Your analysis highlights the importance of understanding these indices for better forecasting. I appreciate the practical examples you provided, which make the concepts more accessible for readers. Looking forward to more of your work!

April 8, 2025 at 11:43 AM

Knight Barrett

Thank you for your kind words! I'm glad you found the article insightful and the examples helpful. I appreciate your support and look forward to sharing more in the future!

Audra McIlwain

Understanding business confidence indices is crucial; they serve as early indicators of economic trends. By interpreting these signals wisely, businesses can strategically navigate potential cycles and seize emerging opportunities.

April 7, 2025 at 11:52 AM

Knight Barrett

Thank you for your insightful comment! You're absolutely right—business confidence indices are vital for anticipating economic trends and can empower businesses to make informed strategic decisions.

Fern Riley

Perception shapes reality; sentiment drives cycles.

April 3, 2025 at 10:37 AM

Knight Barrett

Thank you for your insightful comment! Indeed, perception and sentiment play crucial roles in shaping economic cycles, influencing both business confidence and decision-making.

Isla Reyes

Thank you for this insightful article! Understanding how business confidence indices influence economic cycles is crucial for both entrepreneurs and investors. Your explanations make complex concepts accessible, highlighting the importance of staying informed. Looking forward to more discussions on this vital topic!

April 2, 2025 at 6:55 PM

Knight Barrett

Thank you for your kind words! I'm glad you found the article helpful. Stay tuned for more insights on this important topic!

Victor McCall

Thank you for this insightful article! Your analysis of how business confidence indices correlate with economic cycles sheds light on the complexities of market behavior. It’s fascinating to see how these indices can serve as valuable indicators for future trends, helping businesses navigate uncertainties more effectively. Looking forward to your next post!

March 31, 2025 at 4:01 AM

Knight Barrett

Thank you for your kind words! I'm glad you found the article insightful. Stay tuned for more on this topic!

Mackenzie Jennings

Great insights! Understanding these indices really helps us navigate economic ups and downs.

March 30, 2025 at 11:48 AM

Knight Barrett

Thank you! I'm glad you found the insights helpful for navigating the economic landscape.

Zareth Thompson

Business confidence: the economic crystal ball that sometimes sees clearer than your morning coffee!

March 28, 2025 at 4:45 AM

Knight Barrett

Thank you! Indeed, business confidence can often provide valuable insights into economic trends, sometimes even more reliably than traditional indicators.

Cerys McLain

Fascinating insights! I'm curious about how shifts in business confidence directly influence consumer behavior and investment decisions. Could these indices serve as early warning signals for impending economic changes? Looking forward to learning more!

March 27, 2025 at 3:41 AM

Knight Barrett

Thank you! Yes, shifts in business confidence can significantly impact consumer behavior and investment decisions, often serving as early indicators of economic changes. I'm glad you're interested in the topic!

MORE POSTS

How Capital Gains Can Affect Your Overall Tax Bracket

How to Use Envelopes to Help You Track Spending

Passive Income for Busy Professionals: How to Start Small and Scale

Developing Smart Spending Habits for a Healthier Financial Future

How Money Scripts Shape Your Financial Decisions

How to Build a Solid Emergency Fund with Small Daily Steps